In the long run, your human capital is your main base of competition. Your leading indicator of where you’re going to be 20 years from now is how well you’re doing in your education system.

Increasing access to federal student loans has been a bipartisan effort in Washington, one that I have supported. But it has created what many experts believe is a bubble in higher education, not unlike the housing bubble that preceded the financial crisis.

FAILING SYSTEMS, FAILING HOPES, REAL COSTS

Education is essential to the economy’s long term growth, to increase production, efficiency, and productivity. Education is critical as a social elevator to identify the most talented members of society and to put them in a position to contribute maximally. Education is vital for preserving and developing our capacities as we transform from an industrial economy into a knowledge economy World Bank.

Yet education is increasingly failing. Let’s refrain from reflecting on the problems created by teachers’ unions and excessive standardized testing in primary and secondary education. They offer clear examples of corporatist rent-seekers who have been allowed to get out of control for political reasons. But the trends in higher education are even more dire, and provide one of the best illustrations of the failure of the Elites to control the benefits of a few rent seekers.

My sons study in one of the world’s best private school. Like others assisted by an army of private tutors, they studied to pass a punitive exam to enter. In this secluded education paradise, opportunities are endless, teachers excellent, classes small, and they prosper. I cannot honestly wonder whether my sons would have a fair shot at this if their father were not a hedge fund manager, but instead a member of the Belgian working class. I know the answer all too well. Social mobility in the developed world has eroded. Inequality has increased, but more critically, fundamental fairness has been compromised. In too many cases, one is prosperous because of their background rather than their innate skills and work.

The higher education systems in developed countries have abdicated several of their roles with costly results. The refusal to select the most academically gifted for costly academic training, the refusal to direct those most suited to it to vocational training, and the denial of the need to teach work-critical skills have all become largely accepted. These abdications take a toll on our societies, in both human and financial terms, producing human capital that is ill-suited to our economic needs. As the higher educational system drifts from its mission, millions of young people spend years foregoing wages and racking up financial debt in order to receive training that will not help them land employment. Not only is this an economic disaster, it is also a social one. As more and more young people who thought they were climbing the social ladder discover that they are instead on the precipice, their anger is mounting.

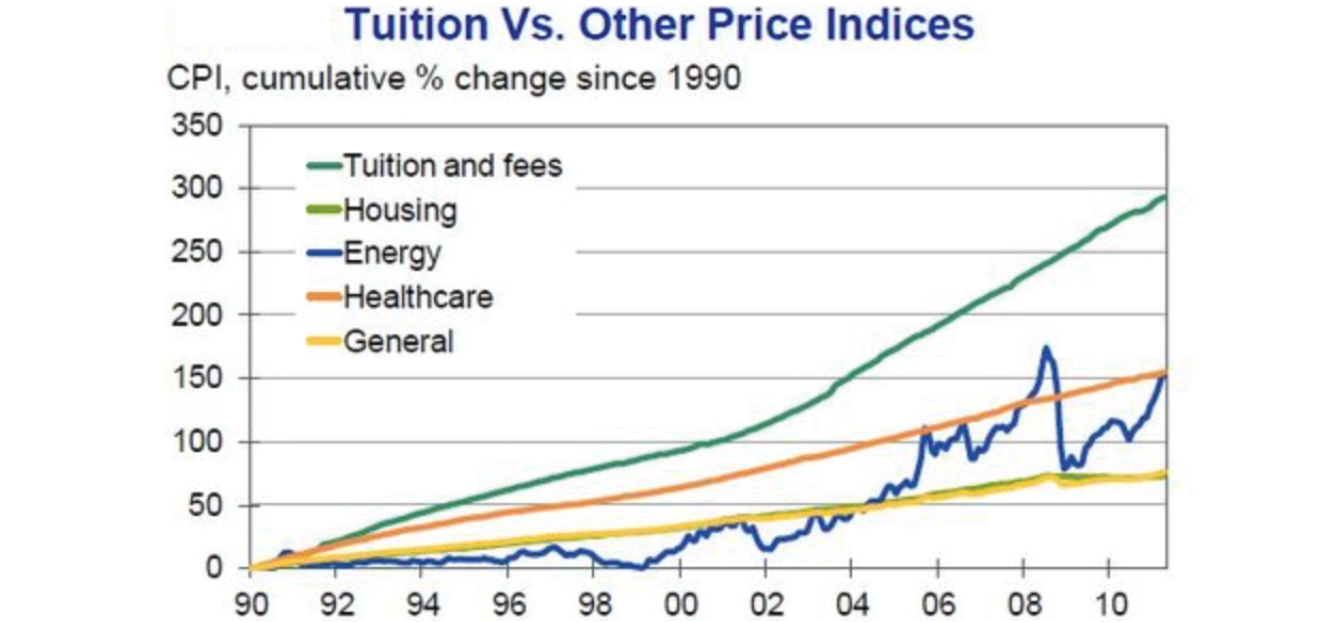

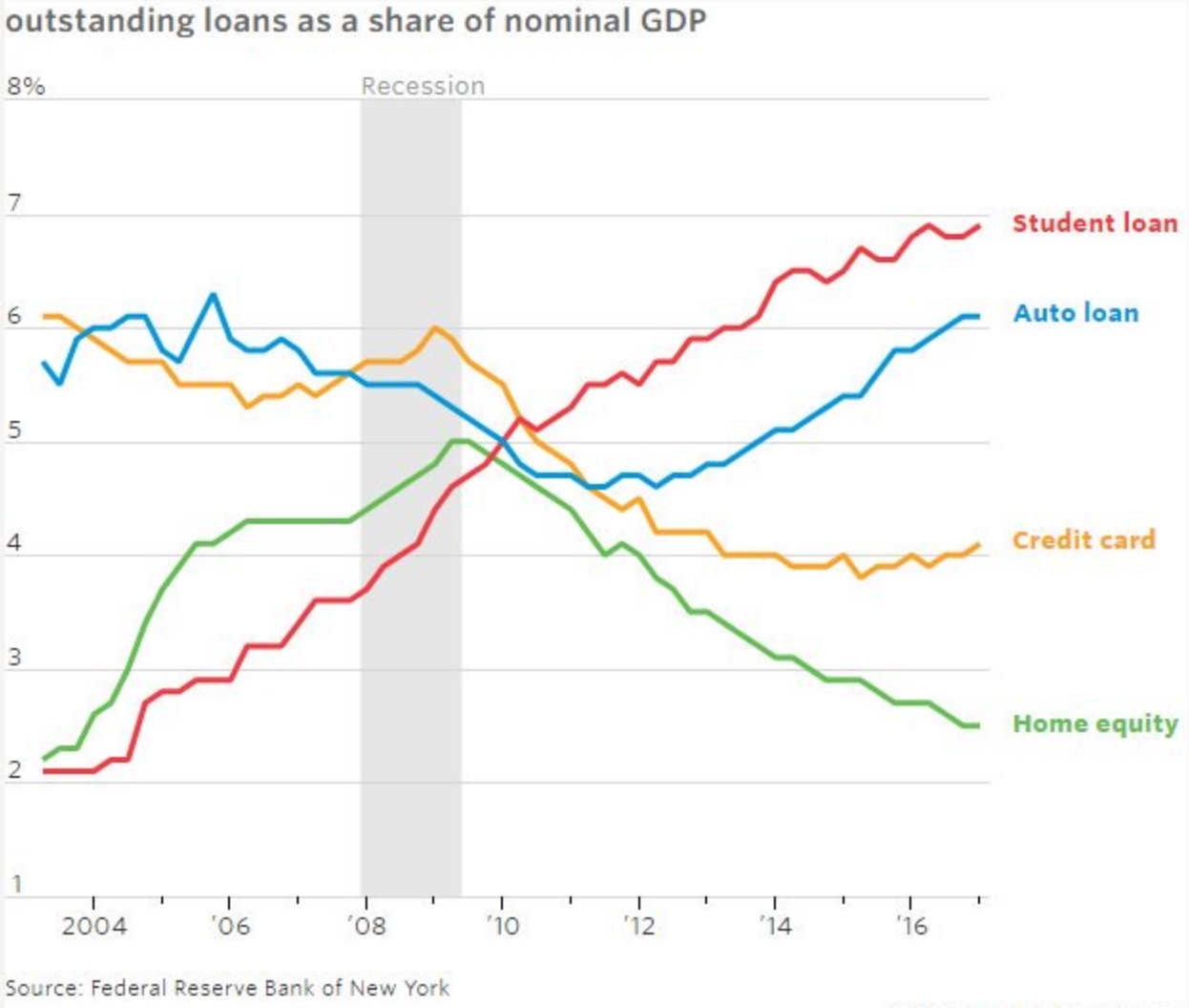

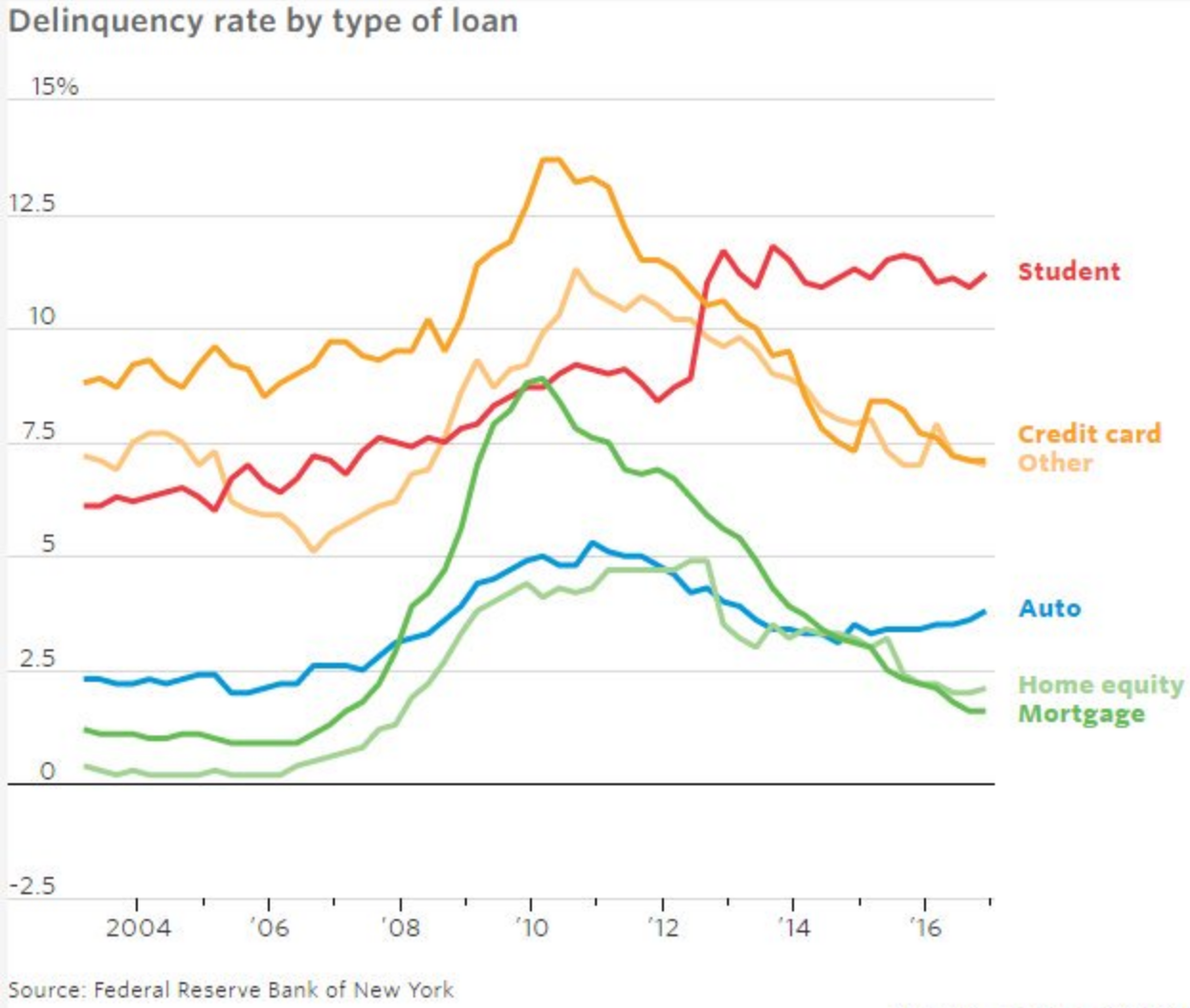

Consider higher education in the U.S. Student debt is now the second largest pool of debt in the U.S., behind home mortgages. It has reached about $1.5 trillion and experiences the highest serious delinquency rate Federal Reserve Bank of New York. As gob smacking as that may seem, it is unsurprising when you consider that the cost of higher education has risen by more than 500% since 1985 The New Republic. In fact, the cost of higher education has increased even more than the cost of healthcare. The combination of skyrocketing education costs and stagnant wages have proven a toxic cocktail. Research suggests that the default rate of student loans stands at about 28%. A 30-year-old is now more likely to have unpaid student debt than a mortgage. A student $50,000 in debt at the end of his study will spend more than $200,000 over his lifetime paying it down. Forty-five million Americans start their working lives with high debt. Brookings

The current student loan system, distorted by poorly designed government subsidies, incentivizes colleges to charge as many students as possible high tuitions for second-rate educations and for programs oriented towards fields that are considered desirable – like the arts and humanities – even if their students have little hope of establishing viable careers in those fields. Higher education providers have no liability when their graduates and dropouts default. So, they have little incentive to limit students, orient them towards vocational training, or even teach to the long-term needs of the marketplace in order to limit those defaults. Indeed, second-tier establishments or departments have much to lose in refusing applicants or limiting the number of candidates, even if they know a high percentage will be unable to repay the loans that finance these programs.

Europe does not fare much better. Up to half of graduates will either be officially overqualified or just unemployed CIPD. About a third of the workforce in the U.K.’s tight labor market has taken up jobs that require lower academic credentials HESA. According to a survey, whilst 74 percent of European education providers were “confident that their graduates were prepared for work,” only 38 percent of students and 35 percent of employers concurred with this McKinsey. This is a waste of human and public resources.

When the financing of this expensive failure is publicly funded, it is an outright waste of state resources, the students wasting years. When it is private, it is an indirect waste of state resources as ultimately the state ends up paying for the defaulting loans, and the students waste time and any financial credit for years.

Europe has a variety of tertiary education systems. The prominent model is a heavily subsidized education with essentially free tuition. This taxpayer-funded giveaway is unfortunately not matched by the necessary resources to deliver the promised returns. According to the OECD, tertiary education providers’ annual expenditure per pupil in Europe is 40 percent to 60 percent of their U.S. equivalent.

When I studied in Belgian universities, there were several hundred students every year enrolled in journalism. That’s all well and good until you consider that across the entire country there were 10 to 20 journalism positions, maximum, that opened up every year. Even including communication jobs in the corporate world, there was no chance that these students would possibly find a job demanding the qualification they had worked for. Yet, year after year, the same thing went on, to this day. Students happy to go for a “softer” and “prestigious” field, the university happy to collect tuition from the state, and all failing in their mission to give students the skills required to become productive members of the economy of the future.

Worse, the subsidized price of education results in further resource misallocation. Students, misjudging both the costs of education and their odds of success, overcrowd and overstay in tertiary education. Ultimately this results either in high failure rates (as in France, for example, where the university completion rate is 40 percent of enrollees) or prolonged studies (as in Germany, where the median time it takes to earn a degree is seven years). Overwhelmed and underfunded, education providers end up having no economic incentive to offer courses in line with the economy’s needs.

Under increasing national budget constraints, a U.S.-style system of sizable up-front fees is gaining ground. The U.K. has tried to introduce a middle way. There, university fees were substantially increased in 2012. Tuition is capped at £9,000 (about $12,000) per year, which is a lot by European standards and a bargain by U.S. standards. Students finance their studies through government loans with repayment collected through the income tax system once their income exceeds £21,000 (about $28,000.) While this provides students with a truer sense of the cost of education, resulting in higher completion rates, it doesn’t solve a more fundamental problem: The better-funded universities still have little incentive to adapt their teaching to market needs. Just as in the U.S., the result is a growing rate of loan default. Indeed, it is worth noting that while all other forms of debt follow a cyclical pattern in their default rate, student debt is the only category that is systematically trending up throughout the economic cycle.

In the U.K. too, this waste of human resources has a direct fiscal cost. The Office for Budget Responsibility projects that in the next two decades student loans will add an additional 10 percent of GDP to the U.K. public debt. In about 50 years, it is estimated that 45 percent of outstanding loans will be written off. The failure of universities to develop graduates who are employable imposes a direct cost on society that comes with defaulted loans as well as a social cost that comes with underemployment. But also, an indirect one, through the human resources that will have stood unused for years and will simply not have been trained to produce and contribute to the best of their abilities.

HUMAN CAPITAL CONTRACTS

In sum, unincentivized education systems, across various countries, are increasingly failing both students and society. It’s time for genuine reform and alignment of interests. In all cases, a set of rent-extracting universities – despite most of them being technically incorporated as nonprofits – have been allowed to maximize their profits while acting as if students’ time was a free resource. The state has abdicated its supervisory and long-term strategic planning roles. It pretends education is not underfunded, allowing rent extractors to boost their profit, disregard the value of students’ time and dispense with teaching useful skills. Policymakers know full well this is inhibiting economic development, imposing human costs and financial losses Palacios.

The bottom line is that higher education and universities’ interests are misaligned with those of society and the students. While universities should still be free to educate minds without a slavish devotion to job metrics, there are ways to incentivize education providers so that they will invest more in providing students with long-term marketable skills.

In a knowledge-based economy, human capital is the single most important resource. Skills are in high demand but in short supply, translating into increasing income inequalities and lost growth potential. This shortage is due to an obsolete financing of the education system that misaligns interests and prevents reform.

HUMAN AND SOCIAL CONSEQUENCES

Failure to address these realities is creating increasingly costly and dangerous economic, social and political dislocation.

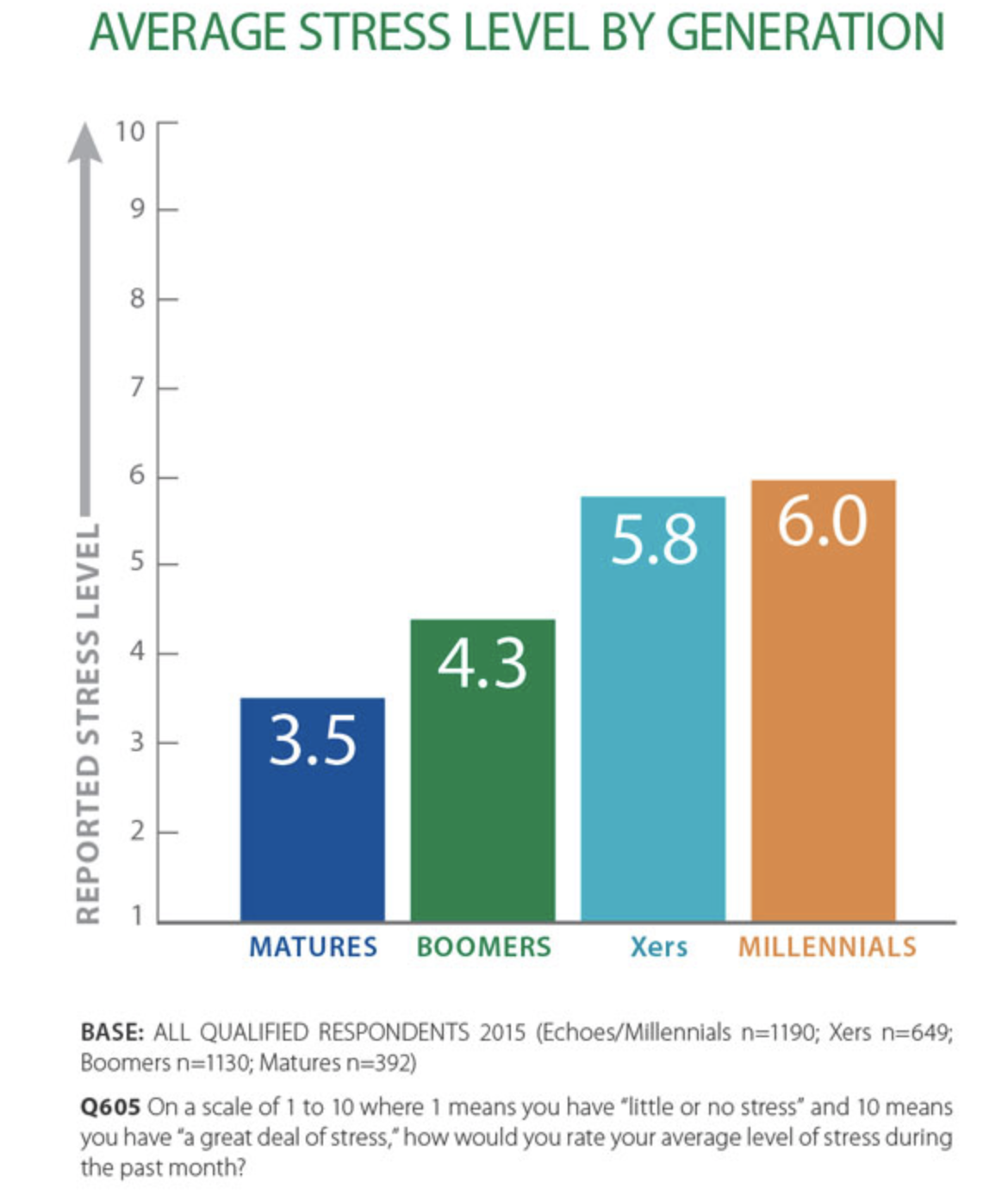

It is also making young people miserable. In the U.K., the number of students receiving psychological counselling increased by 28% after university tuition increased. In the U.S., about 70% of students borrow to finance their study Guardian. According to one recent survey, two-thirds of students borrowing for university reported physical symptoms of anxiety due to stress over their debt, with nearly as many reporting sleepless nights. These problems do no disappear at the campus gates: Eighty percent of working professionals with student debt report it is a significant or very significant source of stress Insler.

I have the pleasure and privilege to teach an advanced class in finance at a respected European university, from which I graduated too many years ago. Students sometimes come to me at the end of this sought-after program, seeking advice about their job options. It turns out that the wage they are being offered is the same as what my classmates and I were being offered decades earlier. The only difference is at the time we could conceive buying a small flat on its basis. Today’s grads are principally looking to pay back their student debt.

But the system is not designed to make students consider such problems when choosing their academic paths. Only 30% of U.K. students say they knew, when choosing their program, what the job placement rate was for that program or had an idea of average wages or possible job openings in areas related to their studies McKinsey. In the U.S., 34% of students reported they had minimal or no understanding of tuition costs. The lack of information on outcomes, a disregard for vocational training, and misaligned financial incentives all contribute to the increasingly high student loan default rate NAR. Unsurprisingly, students who attended for-profit college are experiencing the highest default rate, four times as high as community college Fain.

It would be one thing if education reliably led to higher wages, which would then result in a greater capacity to repay these larger loans. Unfortunately, this is not the case. Only a fraction of students achieve wage gains that clearly justify the cost of their educations, usually those graduating with STEM degrees from top universities. For the rest, default rates of up to 30% among some U.S. education programs have been reported. This has led to the financial crowding-out of millennials, who are unable to buy exorbitantly priced real estate while constrained by levels of debt their parents and grandparents never had to contend with. This has resulted in what is known as the “Great Delay,” with more than a third of millennials, over 20 million Americans, still living with their parents. They are forced to delay moving out, delay forming a family of their own, delay life Kreighbaum.

The poet Langston Hughes once asked, “What happens to a dream deferred?” The end of the poem suggests an answer: it explodes. Our tertiary education system is deferring and sabotaging the aspirations of tens of millions, and the system looks poised to explode.

In the meantime, students pretend to pay, universities pretend to teach, and in the end the government will have to foot the bill while all miss an opportunity and suffer.